The InsurTechNZ ‘Connect’ event at the Mindlab on 29 June featured an industry panel discussion led by Deloitte’s AI representative, Amanda Williamson. The conversation navigated the exciting, yet challenging landscape of AI in the insurance sector. Panellists, including Megan Bonetti, GM, Legal, Partners Life, Dale Smith, CEO of JAVLN, Roneel Kumar, co-founder & CTO, Folio Insure, and Gabriela Mazorra, Data Use Specialist (Governance & Ethics) at Xero and an Executive Member of AI Forum, expressed excitement about AI’s transformative potential but also cautioned about the associated risks, emphasising the importance of robust governance and stringent security measures.

The panel explored the implications of AI bias, strategies for integrating AI in insurance technologies, and the need for ethical considerations in AI usage. While acknowledging the risks, the discussion also highlighted AI’s potential to revolutionise customer acquisition, claims processing, and fraud detection in the insurance industry.

Fostering AI Literacy

In light of these discussions, the necessity for AI literacy becomes evident. It is only through understanding AI that we can maintain trust in its application, ensuring technological advancements benefit customers, companies, and society.

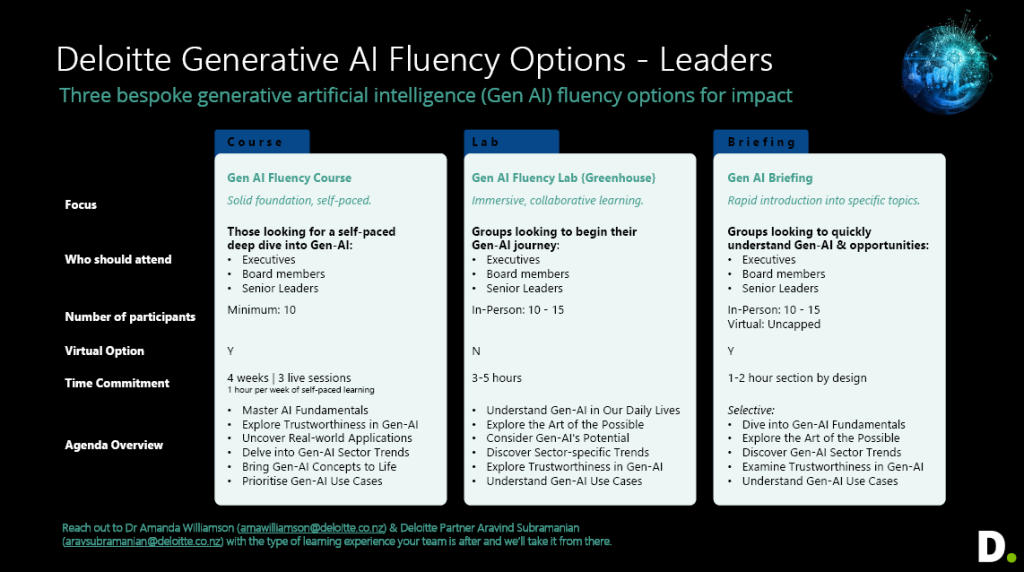

InsurTechNZ member company Deloitte facilitates ‘AI Fluency’ workshops for leaders. See below for more details, or contact amawilliamson@deloitte.co.nz or kybryant@deloitte.co.nz